INVESTMENT PORTFOLIO

We believe in looking past the spin of a sales brochure to the cracks in the pavement.

Understanding the details of a property is essential to evaluating its ability to produce revenue long-term.

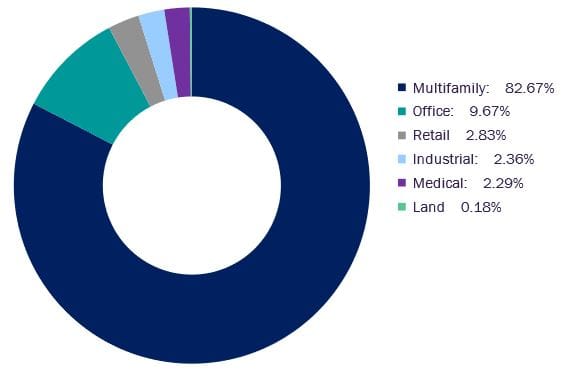

INVESTMENT MIX

Our portfolio is diversified across a number of measures, including tenancy, lease duration, financing terms, and geography. This mix of financing terms and opportunity for near-term rate adjustments support longer-term, sustainable and growing cash flows. At this time, Sterling Multifamily Trust has no plans to sell those portions of its portfolio outside the multifamily sector.

Diversified by Industry

(As of December 31, 2024)

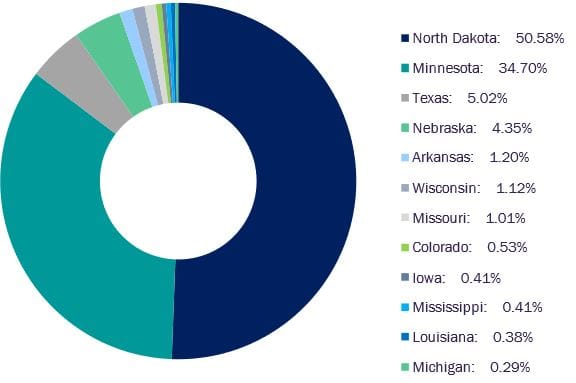

GEOGRAPHIC MIX

Over eighty-eight percent (85.30%) of our portfolio is strategically located in North Dakota and Minnesota where the oil, agriculture and technology sectors are driving growth, property values are stable, incomes are rising and unemployment is low. Multifamily properties outside of North Dakota and Minnesota are located in communities with strong fundamentals, including one or more colleges or universities.

Diversified by State

(As of December 31, 2024)

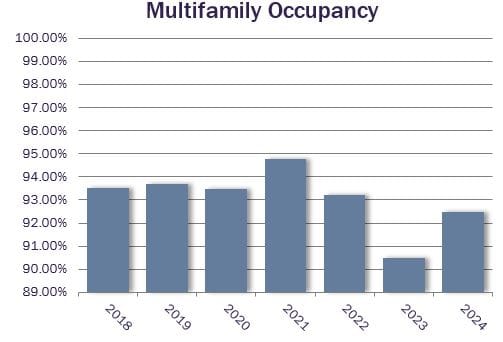

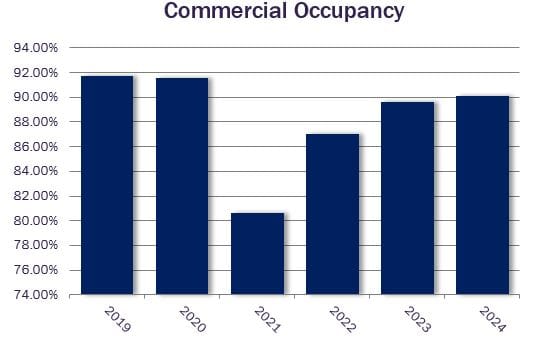

OCCUPANCY

As of December 31, 2024, Sterling Multifamily Trust has built a portfolio of properties totaling more than $1.1 billion based on purchase price. Our properties are geographically diverse with locations in twelve (12) states. Even more important, overall occupancy is 92.49% in our multifamily and 90.10% in our commercial sectors. At this time, Sterling Multifamily Trust has no plans to sell those portions of its portfolio outside the multifamily sector.

Multifamily Occupancy

Commercial Occupancy

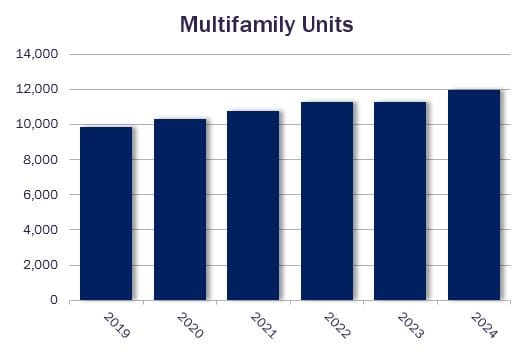

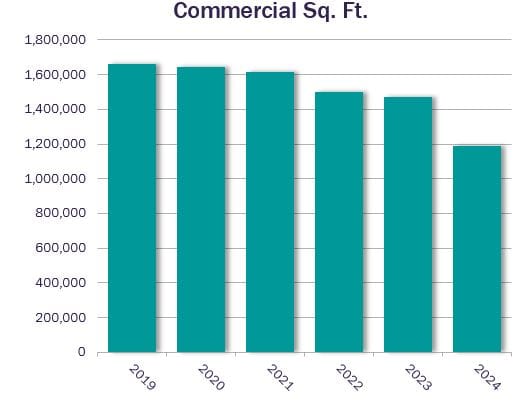

TOTAL UNITS & SQUARE FEET

As of December 31, 2024 our portfolio holds 11,955 multifamily units and more than 1.19 million square feet of rentable commercial space. Our properties are diverse across a number of measures, including tenancy, lease duration, financing terms, and geography. While our multifamily portfolio includes many short-term leases, our commercial leases will generally have terms of 10 or more years. This mix of lease terms and opportunity for near-term rate adjustments support longer-term, sustainable and growing cash flows. At this time, Sterling Multifamily Trust has no plans to sell those portions of its portfolio outside the multifamily sector.

Multifamily Units

Commercial Sq. Ft.

Multifamily Real Estate

See a comprehensive list of the Trust’s multifamily properties located across eleven states.